.png)

Bernt Ausland

Partner • Leader of Financial Advisory • Stavanger

The story of Deep Value Driller is one of how a small team can create significant value—but also of the importance of having the right support—and technology—behind you. Here’s how Aider helps the offshore company with far more than just accounting.“The CEO handles operations and the marketing side, but has effectively outsourced the entire finance function to Aider,” says Bert Ausland.

He is employed by Aider and serves as the company’s CFO, which was founded in 2021. After raising $85 million in capital, founder and CEO Svend Anton Maier purchased a modern drilling vessel. Shortly thereafter, the company was listed on Euronext Growth.

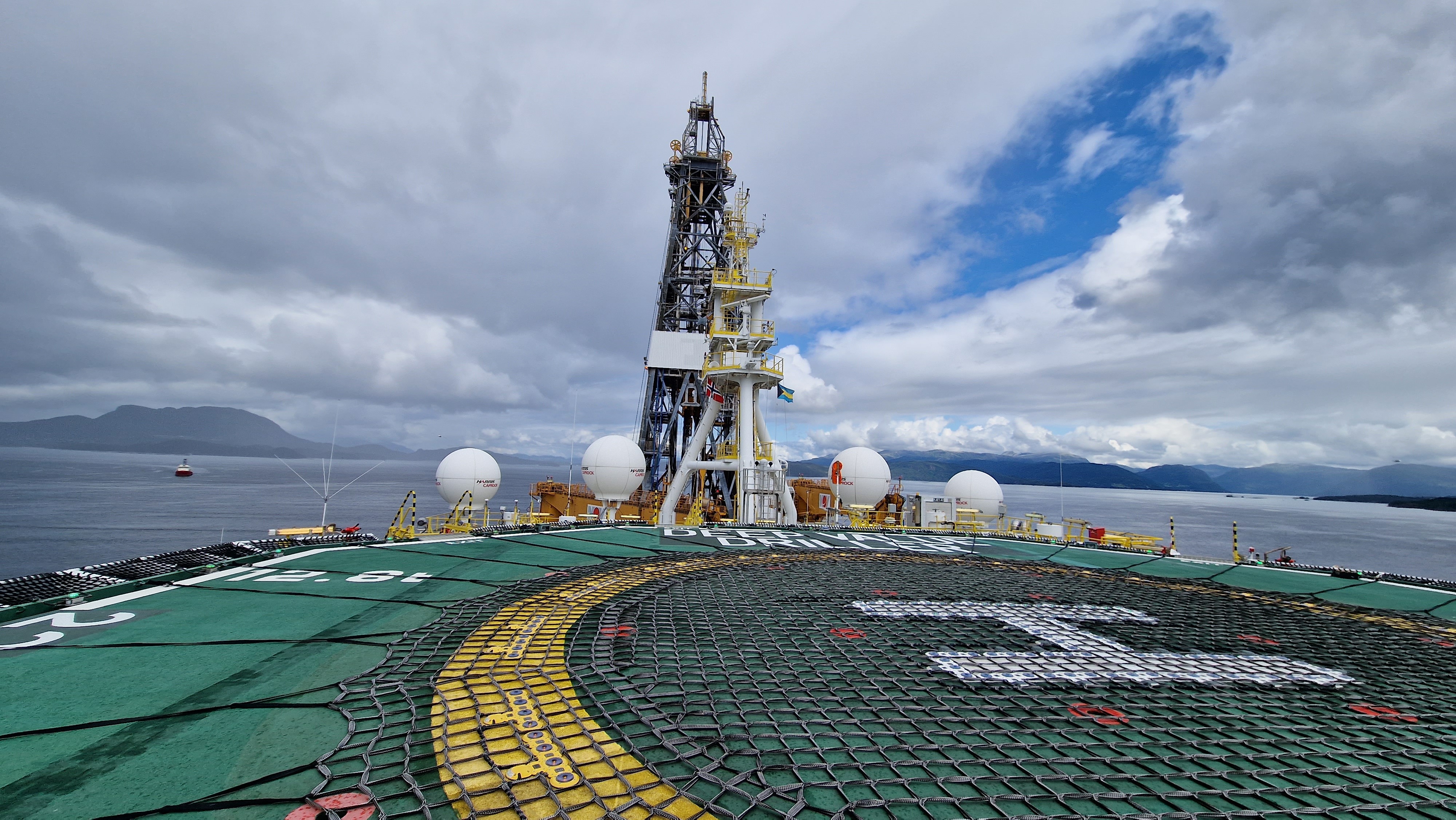

But how do you run a publicly listed, international company with only one employee—a CEO based in Malta? For Deep Value Driller, the solution was simple: leverage the expertise of a full-scale competence house.

Deep Value Driller needed a solution capable of handling everything from day-to-day accounting to complex stock exchange reporting requirements—while also managing the company’s multinational structure.

With operations in both Norway and Malta, accounting had to be recorded and reported in multiple currencies: dollars for the stock exchange, euros, and Norwegian kroner for regulatory authorities. Aider now manages this entire multi-currency structure.

Before the vessel could begin drilling for oil, the entire rig had to be made operational.

“This was an extensive recertification project with costs on par with what the company paid for the drilling vessel itself, which naturally required close cost monitoring and reporting. While the company hired project managers to handle the technical aspects of oil drilling, it was Aider that managed the purchase orders and cost tracking,” explains Ausland.

Part of the key to success has been the proper use and optimization of the ERP system Xledger, in which Aider has leading expertise. With a dedicated Xledger environment supporting them, Aider helped Deep Value Driller implement solutions that efficiently handled multi-currency, group accounting, and consolidation.

“With Aider backing us, we don’t need an in-house finance function. They have the breadth, technical expertise, and flexibility that allow us to focus entirely on our core business.”

– Svend Anton Maier, CEO, Deep Value Driller

The team from Aider now handles all accounting, project monitoring, taxes, sustainability, and more. As a result, Aider functions as a full-service, flexible, and scalable one-stop shop for all of Deep Value Driller’s financial needs.

“At the same time, we are likely very cost-effective compared to the large audit firms. With such a broad range of expertise gathered under one roof, Aider is uniquely positioned to take on this type of assignment at a reasonable price,” says Ausland.

Today, Deep Value Driller’s drilling vessel is fully operational for an international operator, and CEO Maier can relax—confident that reporting to the stock exchange and regulatory authorities is accurate and precise.

.png)

Partner • Leader of Financial Advisory • Stavanger